Portfolio

A selection of our Projects and White Papers

-

Retail Execution – Casting the Net Wider

Wealth and retail execution charts new waters

Find out more > -

Stifel SWIM – Från klarhet till klarhet

SWIM makes great headway in first half year of trading

Find out more >

SWIM gör stora framsteg in i första halvåret av handeln -

Stifel launches SWIM liquidity hub

Stifel’s innovative SWIM liquidity pool introduces a unique mechanism to

Find out more >

search and interact with retail electronic orders. -

Transaction data meets the GIG economy

The new generation of EDM tools isn’t about building another behemoth, it’s about smart-data-management. Misato explore a changing mindset in this article about Transaction Data.

Find out more > -

A look back at the future

WIth MiFID II upon us, this series of articles for network instrumentation specialists Accedian explores the value of all that synchronous data...

Find out more > -

Turning Water into Wine

MiFID II mandates the time-stamping and storage of transaction data. A non-trivial task, but one that presents a valuable data-store, now with sequential integrity.

Find out more > -

A Sea Change in Surveillance

Impending regulation and next generation technology

Find out more >

drives new wave of monitoring -

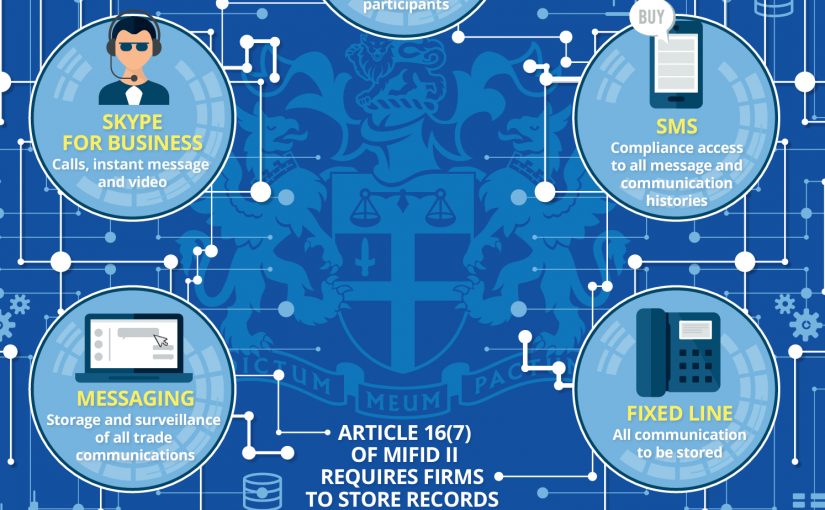

My Word is My Bond

“Dictum Meum Pactum” - My Word Is My Bond. The motto of

Find out more >

the London Stock Exchange has underpinned the values of the

City for generations. In the current era of fast-paced technical

and regulatory change, upholding the integrity of our financial

markets is no less critical. Although the Exchange’s trading floor

itself has become a thing of the past, human interaction is as

important to the trading ecosystem now as it was pre-Big Bang.

Conversely, the challenge of surveilling such human interaction

has increased in line with the expansion of different forms of

media from traditional voice, to include mobile, SMS, business

social media and instant messaging. -

Market Abuse Monitoring goes Forensic

For those overseeing the orderly conduct of trading, the Market Abuse Regulation (MAR)

Find out more >

in mid-2016 introduced some significant challenges. Specifically, MAR extended the scope

of surveillance to orders as well as trades in order to capture the intent to abuse the market,

and it applied to more asset-classes, to name but a few of the changes.